In the February 2010 Javelin Strategy and Research report on financial alerts, some of the major flaws of current alerts included difficulty of setting alerts up, lack of timeliness, not actionable enough and poorly marketed. In addition, the research found that one of the highest utility features from both a customer and bank perspective is the ability to alert and respond to potentially insufficient funds.

Expanding on their very popular low balance alert mobile banking feature, Chase Bank just introduced a new feature that addresses many of these flaws by allowing customers to easily respond to a low balance alert from the bank by immediately transferring funds through text messaging.

The new feature will allow customers to transfer funds from any eligible checking, savings or money market account simply by typing the letter "T" followed by the dollar amount of transfer desired (for instance, to transfer $100, the customer simply types "T 100"). If the customer has more than one eligible account with adequate funds, both accounts with the balance available to transfer will be shown, along with the option to use either account to fund the low balance account.

To be eligible for this service, a customer simply needs to be a Chase Mobile customer, have the ability to send and receive SMS texts, and sign up for the Instant Action Alerts. As an added benefit, the customer can even set the time they want to receive notification during the day.

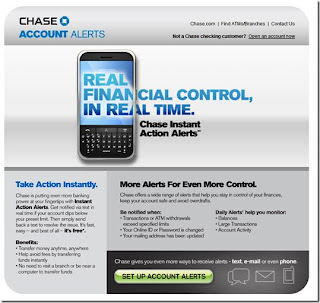

While not promoted on the Chase homepage as of this writing, an animated landing page (shown above) is being used in conjunction with Google AdWords using search terms like "overdraft alerts" and "mobile banking alerts".

Payments innovation is becoming more and more commonplace with Chase Bank as indicated in several of my Blogs this year, including the introduction of Chase Blueprint. These innovations in most cases enhance the customer experience while also reducing operating costs. It will be interesting to see what other innovations are on the way from Jamie Dimon's team.

Hi Jim,

ReplyDeleteI am curious about Chase's Instant Action Alerts. Are the alerts sent out at the moment the account goes below the predefined limit? Or is it such that the customer can take instant action on a low balance alert that is received once per day - not necessarily at the time a transaction actually takes the account below the limit. I have been finding differing opinions.

Thanks.